Fidelity Bank customers can now enjoy increased convenience with their Automated Teller Machine (ATM) transactions as the bank recently announced the introduction of its cardless withdrawal service.

The feature allows Fidelity Bank accountholders to make withdrawals at any Fidelity Bank ATM nationwide with the aid of their registered phone numbers alone.

Speaking on the new feature, Divisional Head, eBanking, Fidelity Bank Plc, Ifeoma Onibuje said, “We know how frustrating it can be when you get to the ATM only to discover that you forgot your debit card at home. To address this and in support of the cashless policy, we recently introduced cardless withdrawals via our ATMs. The service is currently available at all Fidelity Bank ATMs across the country and we are recording favourable feedback from customers who have used the service.”

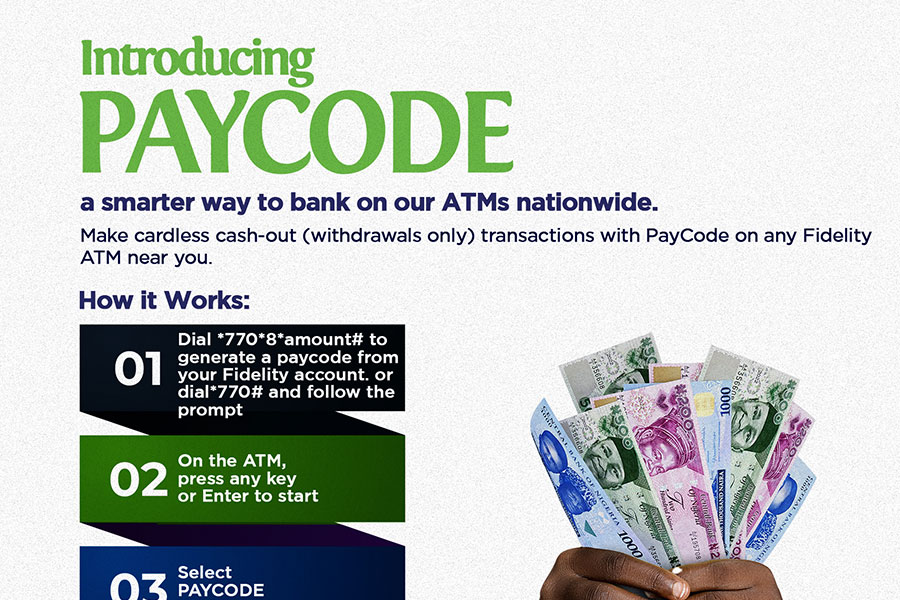

For cardless withdrawals, requesting customers would simply dial *770*8*AMOUNT# from their registered phone numbers and follow the on-screen prompts to create a one-time PIN (OTP), then enter the PIN to get a Paycode. At the ATM, the customer would enter the Paycode, PIN, and Amount to get the cash.

“The introduction of cardless withdrawals forms part of our strategy to help our customers transition to the newly introduced Naira notes as well as the cashless policy. You will recall that we extended our banking hall service to 6pm on weekdays and have our branches open between 10am and 2pm on Saturdays till the end of January 2023. Similarly, we have configured our ATMs to dispense the newly introduced currencies and customers are now accessing the redesigned Naira notes through all our ATMs nationwide,” divulged Onibuje.

Fidelity Bank is a full-fledged commercial bank operating in Nigeria with over 7.2 million customers serviced across its 250 business offices and digital banking channels. The bank was recently recognized as the Best SME Bank Nigeria 2022 by the Global Banking & Finance Awards. The bank has also won awards for the “Fastest Growing Bank” and “MSME & Entrepreneurship Financing Bank of the Year” at the 2021 BusinessDay Banks and Other Financial Institutions (BAFI) Awards.