Frequently Asked Questions

Home / Contact Us / Frequently Asked Questions

CASHLESS POLICY

- N500,000 for individual accounts

- N3,000,000 for corporate accounts

- N150,000 for third party withdrawals

Yes, a signatory to a Corporate Account is not a third party.

A. No, Payment from Government Accounts to Vendors and Staff ordinarily should be done through E-Payment platforms.

- 3% of any amount in excess of the cumulative daily limit for withdrawals from individual accounts

- 5% of any amount in excess of the cumulative daily limit for withdrawals from Corporate accounts.

Cash withdrawals across the counter and through ATMs

- ATMs

- Point of Sale (POS) Terminals

- Internet banking

- Cheques

- Electronic transfers eg RTGS, NEFT, NIBSS Instant payment, direct debit instructions

- Online Collections via Fidelity paygate/E-Pay and Paydirect

- Mobile Payments (Mobile Money)

The system automatically takes the cash lite charge from the account as soon as the transactions are posted.

No. all withdrawals will be treated while the applicable charges will be taken on same.

- Yes. Micro finance Banks, Primary Mortgage Institutions on their accounts with commercial banks.

- Ministries, Departments and Agencies (MDAs) of Federal and State Governments on lodgements into their Collection Accounts ONLY

- Accounts of Embassies, Diplomatic Missions, Multilateral and Aid Donor Agencies.

NAIRA CREDIT CARD

Step 1: Request for a new PIN in any of the Fidelity closest Branch

Step 2: You’ll receive SMS alert with 24 hours, Slot your card into Any Fidelity bank ATM and select any random 4 digits Number and press enter.

Step 3: Select “change PIN” to enter your preferred 4 digits PIN.

Step 4: Re-enter the PIN the second time and submit.

- ATM withdrawals: 8 times daily with a cumulative transaction limit of ₦150,000 or its equivalent in any currency if the transaction is done abroad.

- POS/ Web: 20 times daily with a cumulative spend limit of ₦1,000,000 or its equivalent in any currency if the transaction is done abroad or on international websites.

- Cost of Card is ₦1050

- Card re-issuance fee due to expiration is ₦1050

- Card re-issuance fee due to damage, loss or theft is ₦2000

- No Annual fees

- No transaction fees on POS and Web

- Monthly Card maintenance fee of ₦250, ₦500 and ₦1000 ( Classic, Gold and Platinum Respectively)

- Monthly interest rate of 2.5% on outstanding balance

- Cash withdrawal fee at ATM (International: ₦240 + 1% of transaction amount , Domestic : ₦150 +1%)

- Late payment – ₦2,000

- PIN Re-issue, Processing Fees – Free

- POS Cash Advance – Free

- Duly filled Credit card application form.

- Letter of Charge

- Approved Executive Summary signed off by Regional/Group Head.

- If Individual – executed Personal Guarantee

- If Corporate – executed Corporate Guarantee

- Driver’s License/International Passport/National Identity Card.

- Current Passport Photograph.

- BVN

- Cycle is 45days, statement date is 15th and due date is 28th of every month with a 14 day grace period.

- Repayment is 10% of outstanding balance, due on the 28TH of every month

- The Credit card can be used at the ATM, POS and Web.

- Use domestically and internationally; anywhere in the world where the VISA logo is displayed

Your Fidelity is very safe because it has added advantage of Verified by Visa IPIN which ensures that while paying for goods on the internet, ONLY the true owner of a card can authorize payment on the card.

Follow these easy steps next time you’re shopping online to activate your Verified by Visa iPIN.

- Click the ‘CHECK-OUT’ button or the ‘PAY-NOW’ button while shopping.

- Enter your card details as required by the website.

- The VbyV screen appears on the website.

- Enter your card details.

- Enter ID Number as provide in your Credit card application form.

- Enter Date of birth in the format YYYY as year of birth, MM as month of birth, and DD as day of birth.

- Enter Card expiry date as shown on the card in the format YYYY as year of expiration, and MM as month of expiration

- Click the ‘NEXT’ button to input a NEW 4 digit PIN.

- Click the ‘END’ button when done.

NAIRA PAY ROLL

- ATM withdrawals: 8 times daily with a cumulative transaction limit of ₦150,000 or its equivalent in any currency if the transaction is done abroad.

- POS/ Web: 20 times daily with a cumulative spend limit of ₦1,000,000 or its equivalent in any currency if the transaction is done abroad or on international websites.

- Cost of Card is ₦1050

- Card re-issuance fee due to expiration is ₦1050

- Card re-issuance fee due to damage, loss or theft is ₦2000

- No Annual fees

- No transaction fees on POS and Web

- Monthly Card maintenance fee of ₦250, ₦500 and ₦1000 ( Classic, Gold and Platinum Respectively)

- Monthly interest rate of 2.5% on outstanding balance

- Cash withdrawal fee at ATM (International: ₦240 + 1% of transaction amount , Domestic : ₦150 +1%)

- Late payment – ₦2,000

- PIN Re-issue, Processing Fees – Free

- POS Cash Advance – Free

- Duly filled Credit card application form.

- Letter from employer stating irrevocable domiciliation of salary and gratuity/terminal Benefits.

- Letter from employer confirming applicant’s monthly, annual salary and length of service with the Organisation.

- 3 months’ Payslip

- Driver’s License/International Passport/National Identity Card.

- Photocopy of Employee identity card.

- Current Passport Photograph.

- Letter of Charge

- BVN

- Cycle is 30 days and statement date is on the 30th of every month.

- Repayment is 100% of outstanding balance, due on the 2nd of every month.

- The Credit card can be used at the ATM, POS and Web.

- Use domestically and internationally; anywhere in the world where the VISA logo is displayed

Your Fidelity is very safe because it has added advantage of Verified by Visa IPIN which ensures that while paying for goods on the internet, ONLY the true owner of a card can authorize payment on the card.

Follow these easy steps next time you’re shopping online to activate your Verified by Visa iPIN.

- Click the ‘CHECK-OUT’ button or the ‘PAY-NOW’ button while shopping.

- Enter your card details as required by the website.

- The VbyV screen appears on the website.

- Enter your card details.

- Enter ID Number as provide in your Credit card application form.

- Enter Date of birth in the format YYYY as year of birth, MM as month of birth, and DD as day of birth.

- Enter Card expiry date as shown on the card in the format YYYY as year of expiration, and MM as month of expiration

- Click the ‘NEXT’ button to input a NEW 4 digit PIN.

- Click the ‘END’ button when done.

NAPS

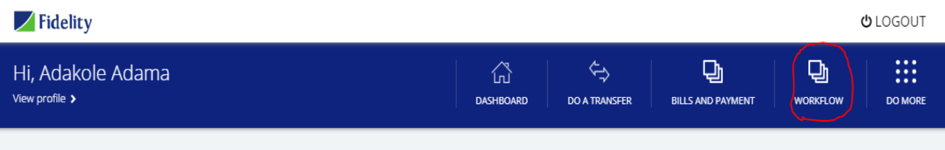

- Log unto Corporate Online Banking.

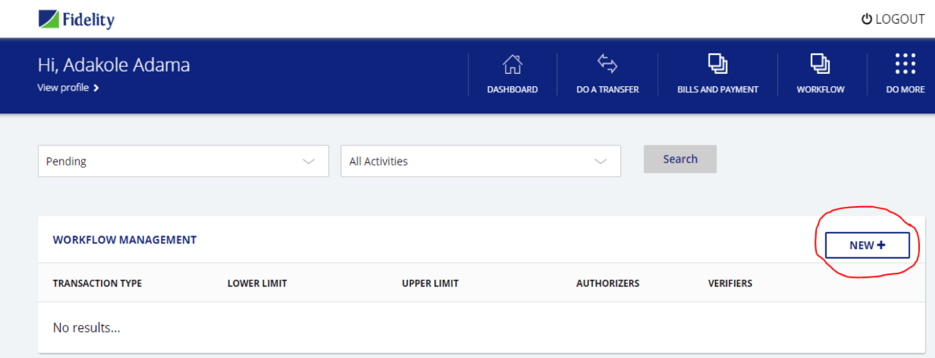

- Click on Workflowto create a transaction workflow.

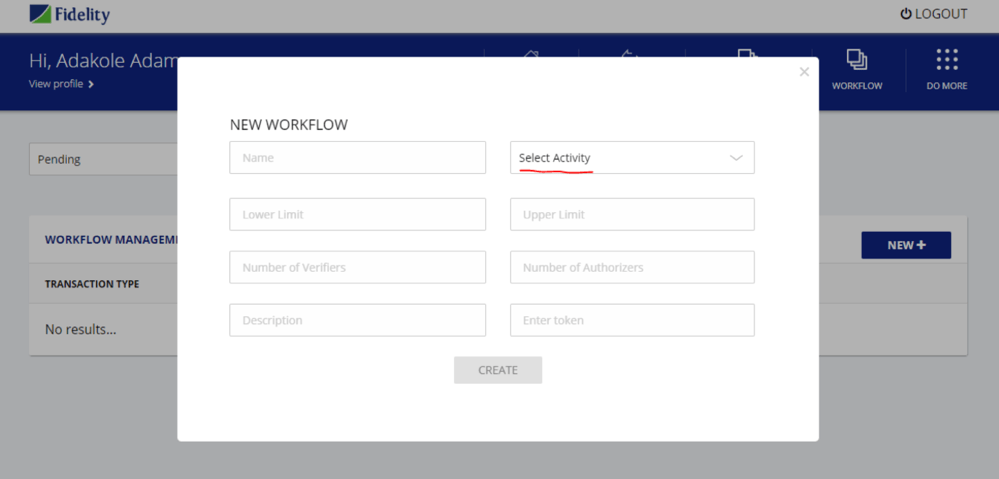

- Click on NEWand populate the field in the popped up page.

- Input the Name you would like to call this specific type of transaction activity e.g. Inter-bank Naps Transfers

- Select Activity from the drop-down the type of transfer you would like to create this workflow pattern for – NAPS

- Lower limit: This is the minimum amount the specific workflow can permit –1

- Upper limit: This is the maximum amount the specific workflow can permit – 500,000,000

- No of verifiers: This is the number of user(s) you want to review the transaction(s).

- No of Authorizers: This is the number of user(s) you want to authorize the transaction(s).

. - Description: You can input the extra details of the workflow here.

- Enter your assigned token one time digits.

- For organizations with multiple users (Admin/Initiator, Verifier and Authorizer) a workflow is required to be setup.

- For Super Admin users, creating a workflow isn’t required as you can immediately begin transacting.

CASHLESS POLICY

- N500,000 for individual accounts

- N3,000,000 for corporate accounts

- N150,000 for third party withdrawals

Yes, a signatory to a Corporate Account is not a third party.

A. No, Payment from Government Accounts to Vendors and Staff ordinarily should be done through E-Payment platforms.

- 3% of any amount in excess of the cumulative daily limit for withdrawals from individual accounts

- 5% of any amount in excess of the cumulative daily limit for withdrawals from Corporate accounts.

Cash withdrawals across the counter and through ATMs

- ATMs

- Point of Sale (POS) Terminals

- Internet banking

- Cheques

- Electronic transfers eg RTGS, NEFT, NIBSS Instant payment, direct debit instructions

- Online Collections via Fidelity paygate/E-Pay and Paydirect

- Mobile Payments (Mobile Money)

The system automatically takes the cash lite charge from the account as soon as the transactions are posted.

No. all withdrawals will be treated while the applicable charges will be taken on same.

- Yes. Micro finance Banks, Primary Mortgage Institutions on their accounts with commercial banks.

- Ministries, Departments and Agencies (MDAs) of Federal and State Governments on lodgements into their Collection Accounts ONLY

- Accounts of Embassies, Diplomatic Missions, Multilateral and Aid Donor Agencies.

NAIRA CREDIT CARD

Step 1: Request for a new PIN in any of the Fidelity closest Branch

Step 2: You’ll receive SMS alert with 24 hours, Slot your card into Any Fidelity bank ATM and select any random 4 digits Number and press enter.

Step 3: Select “change PIN” to enter your preferred 4 digits PIN.

Step 4: Re-enter the PIN the second time and submit.

- ATM withdrawals: 8 times daily with a cumulative transaction limit of ₦150,000 or its equivalent in any currency if the transaction is done abroad.

- POS/ Web: 20 times daily with a cumulative spend limit of ₦1,000,000 or its equivalent in any currency if the transaction is done abroad or on international websites.

- Cost of Card is ₦1050

- Card re-issuance fee due to expiration is ₦1050

- Card re-issuance fee due to damage, loss or theft is ₦2000

- No Annual fees

- No transaction fees on POS and Web

- Monthly Card maintenance fee of ₦250, ₦500 and ₦1000 ( Classic, Gold and Platinum Respectively)

- Monthly interest rate of 2.5% on outstanding balance

- Cash withdrawal fee at ATM (International: ₦240 + 1% of transaction amount , Domestic : ₦150 +1%)

- Late payment – ₦2,000

- PIN Re-issue, Processing Fees – Free

- POS Cash Advance – Free

- Duly filled Credit card application form.

- Letter of Charge

- Approved Executive Summary signed off by Regional/Group Head.

- If Individual – executed Personal Guarantee

- If Corporate – executed Corporate Guarantee

- Driver’s License/International Passport/National Identity Card.

- Current Passport Photograph.

- BVN

- Cycle is 45days, statement date is 15th and due date is 28th of every month with a 14 day grace period.

- Repayment is 10% of outstanding balance, due on the 28TH of every month

- The Credit card can be used at the ATM, POS and Web.

- Use domestically and internationally; anywhere in the world where the VISA logo is displayed

Your Fidelity is very safe because it has added advantage of Verified by Visa IPIN which ensures that while paying for goods on the internet, ONLY the true owner of a card can authorize payment on the card.

Follow these easy steps next time you’re shopping online to activate your Verified by Visa iPIN.

- Click the ‘CHECK-OUT’ button or the ‘PAY-NOW’ button while shopping.

- Enter your card details as required by the website.

- The VbyV screen appears on the website.

- Enter your card details.

- Enter ID Number as provide in your Credit card application form.

- Enter Date of birth in the format YYYY as year of birth, MM as month of birth, and DD as day of birth.

- Enter Card expiry date as shown on the card in the format YYYY as year of expiration, and MM as month of expiration

- Click the ‘NEXT’ button to input a NEW 4 digit PIN.

- Click the ‘END’ button when done.

NAIRA PAY ROLL

- ATM withdrawals: 8 times daily with a cumulative transaction limit of ₦150,000 or its equivalent in any currency if the transaction is done abroad.

- POS/ Web: 20 times daily with a cumulative spend limit of ₦1,000,000 or its equivalent in any currency if the transaction is done abroad or on international websites.

- Cost of Card is ₦1050

- Card re-issuance fee due to expiration is ₦1050

- Card re-issuance fee due to damage, loss or theft is ₦2000

- No Annual fees

- No transaction fees on POS and Web

- Monthly Card maintenance fee of ₦250, ₦500 and ₦1000 ( Classic, Gold and Platinum Respectively)

- Monthly interest rate of 2.5% on outstanding balance

- Cash withdrawal fee at ATM (International: ₦240 + 1% of transaction amount , Domestic : ₦150 +1%)

- Late payment – ₦2,000

- PIN Re-issue, Processing Fees – Free

- POS Cash Advance – Free

- Duly filled Credit card application form.

- Letter from employer stating irrevocable domiciliation of salary and gratuity/terminal Benefits.

- Letter from employer confirming applicant’s monthly, annual salary and length of service with the Organisation.

- 3 months’ Payslip

- Driver’s License/International Passport/National Identity Card.

- Photocopy of Employee identity card.

- Current Passport Photograph.

- Letter of Charge

- BVN

- Cycle is 30 days and statement date is on the 30th of every month.

- Repayment is 100% of outstanding balance, due on the 2nd of every month.

- The Credit card can be used at the ATM, POS and Web.

- Use domestically and internationally; anywhere in the world where the VISA logo is displayed

Your Fidelity is very safe because it has added advantage of Verified by Visa IPIN which ensures that while paying for goods on the internet, ONLY the true owner of a card can authorize payment on the card.

Follow these easy steps next time you’re shopping online to activate your Verified by Visa iPIN.

- Click the ‘CHECK-OUT’ button or the ‘PAY-NOW’ button while shopping.

- Enter your card details as required by the website.

- The VbyV screen appears on the website.

- Enter your card details.

- Enter ID Number as provide in your Credit card application form.

- Enter Date of birth in the format YYYY as year of birth, MM as month of birth, and DD as day of birth.

- Enter Card expiry date as shown on the card in the format YYYY as year of expiration, and MM as month of expiration

- Click the ‘NEXT’ button to input a NEW 4 digit PIN.

- Click the ‘END’ button when done.

NAPS

- Log unto Corporate Online Banking.

- Click on Workflowto create a transaction workflow.

- Click on NEWand populate the field in the popped up page.

- Input the Name you would like to call this specific type of transaction activity e.g. Inter-bank Naps Transfers

- Select Activity from the drop-down the type of transfer you would like to create this workflow pattern for – NAPS

- Lower limit: This is the minimum amount the specific workflow can permit –1

- Upper limit: This is the maximum amount the specific workflow can permit – 500,000,000

- No of verifiers: This is the number of user(s) you want to review the transaction(s).

- No of Authorizers: This is the number of user(s) you want to authorize the transaction(s).

. - Description: You can input the extra details of the workflow here.

- Enter your assigned token one time digits.

- For organizations with multiple users (Admin/Initiator, Verifier and Authorizer) a workflow is required to be setup.

- For Super Admin users, creating a workflow isn’t required as you can immediately begin transacting.